The Russian government said on Tuesday that the capital controls Putin ordered in October are effective and should be extended.On the same day, Russia’s central bank said the impact of the measures is moderate, and they shouldn’t be extended.Current capital control measures requiring exporters to convert foreign currency earnings into rubles expire on April 30.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

download the app

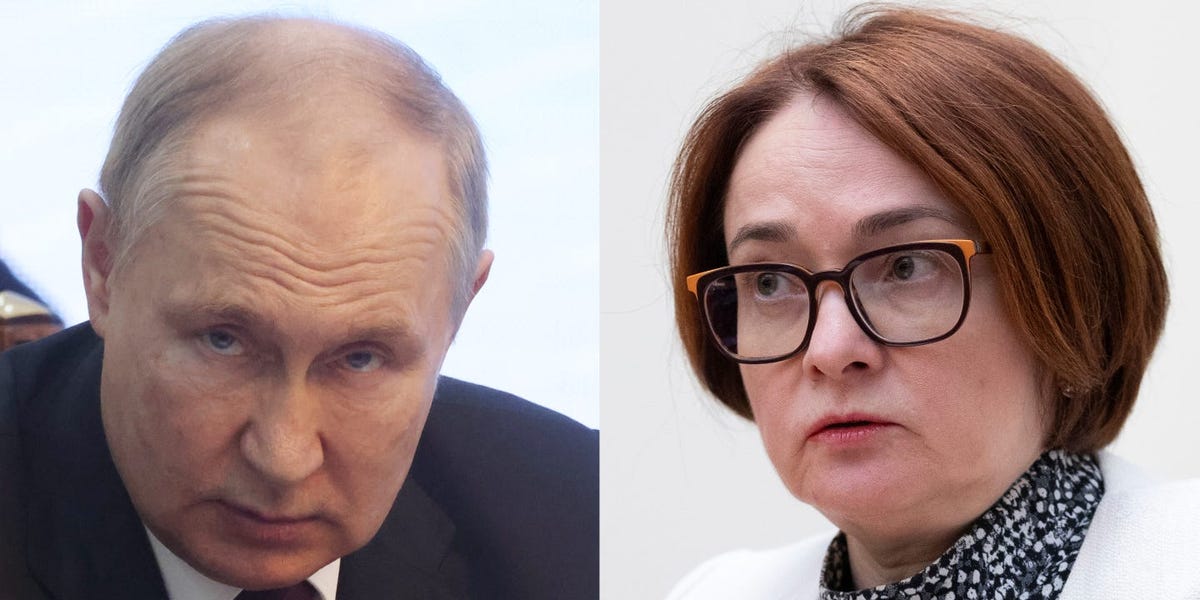

Russian officials are publicly arguing about capital controls, highlighting disagreement in the country’s elite class about how to handle its sanctions-stressed economy.On Tuesday, the Russian government said on its official Telegram channel that the capital controls President Vladimir Putin ordered in October have been effective, and that they should be extended until end-2024, according to the Interfax press agency.The current capital control measures that require exporters to convert foreign currency earnings into rubles expire on April 30. They were introduced in October after the ruble tumbled over 20% against the US dollar.The ruble regained some ground after the measures were introduced, but is still 23% lower over the past 12 months.”The measures have proven to be effective and have helped stabilize the domestic currency market situation by achieving a sufficient level of foreign exchange liquidity,” said First Deputy Prime Minister Andrei Belousov in the government announcement, per Interfax.He said exporters are largely complying with the capital controls and that it’s helping sanctions-hit Russia with imports.However, Russia’s central bank disagrees, saying the impact of the capital controls was moderate and that there’s no “compelling reason” to extend the mandatory sale of foreign currency earnings, per a separate Interfax report on Tuesday.The central bank added that high interest rates — now at 16% — and strong export revenue growth had more impact on the foreign exchange market.It’s not the first time Russian government officials and the country’s central bank have aired their disagreements in public.In August, Putin’s chief economic adviser took aim at the central bank’s monetary policy, which he called “soft,” after the ruble slumped against the greenback.Elvira Nabiullina, Russia’s central bank governor and Putin’s top technocrat for the economy, pushed back against the criticism, saying the ruble’s slide was due to changing trade flows in and out of Russia amid sanctions.She also threw shade at her critics, comparing the criticism of the Russian central bank to the streetlight effect, referring to cognitive bias demonstrated by the tale of a drunk person who searches for his lost keys under a lamp post rather than where he lost them.”Blaming the central bank is like a drunkard’s search — looking for the guilty where the light is,” she said at the time.